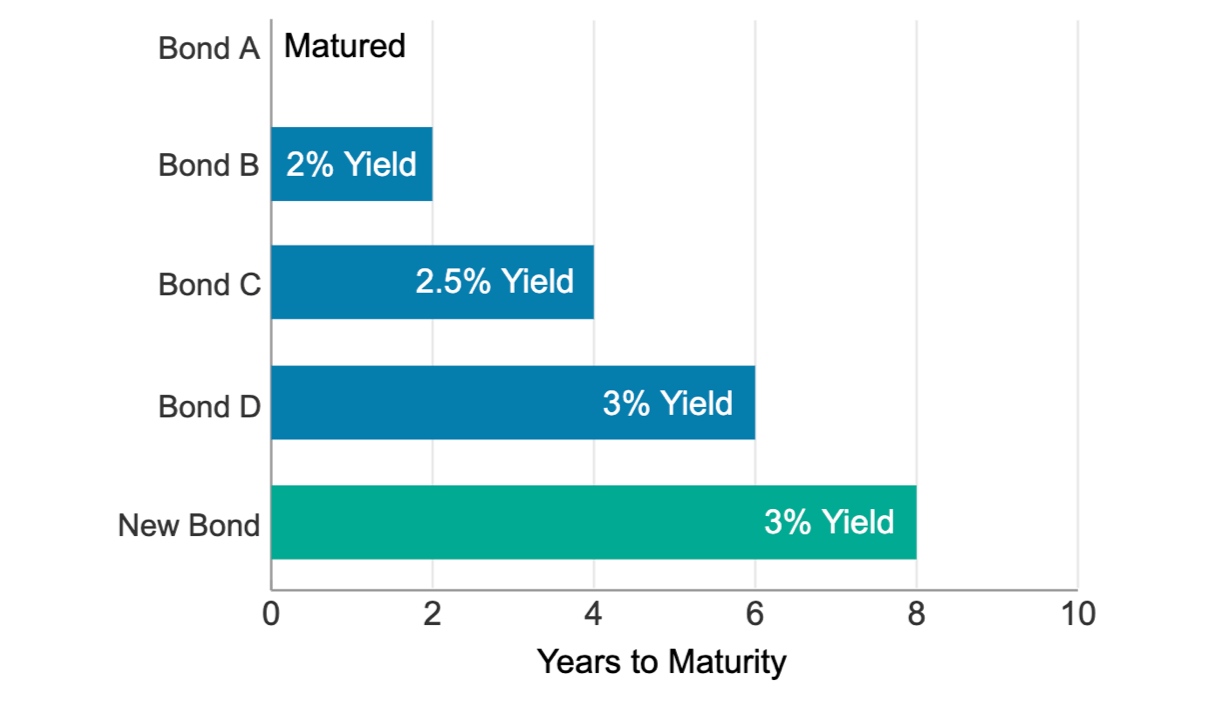

How Does A Bond Ladder Work . A popular way to hold individual bonds is by building a portfolio of bonds with various maturities: How does a bond ladder work?. A bond ladder operates on the principle of diversification, which means spreading your investments. This is called a bond ladder. A bond ladder is a portfolio of bonds with varying maturity dates, where the bonds are held to maturity, and their proceeds are reinvested in new bonds. You should select the number of bonds, maturity dates, and securities that best fit your financial situation and. Invest in a range of bonds with different maturity dates. A bond ladder is an investment strategy that involves constructing a portfolio in which bonds mature continuously at equally spaced. A bond ladder is an investment strategy used to diversify a portfolio of fixed income securities by purchasing bonds with staggered maturities.

from www.schwab.com

How does a bond ladder work?. A bond ladder operates on the principle of diversification, which means spreading your investments. This is called a bond ladder. A bond ladder is a portfolio of bonds with varying maturity dates, where the bonds are held to maturity, and their proceeds are reinvested in new bonds. A bond ladder is an investment strategy used to diversify a portfolio of fixed income securities by purchasing bonds with staggered maturities. Invest in a range of bonds with different maturity dates. A bond ladder is an investment strategy that involves constructing a portfolio in which bonds mature continuously at equally spaced. A popular way to hold individual bonds is by building a portfolio of bonds with various maturities: You should select the number of bonds, maturity dates, and securities that best fit your financial situation and.

Bond Laddering Bond Strategy Charles Schwab

How Does A Bond Ladder Work A bond ladder operates on the principle of diversification, which means spreading your investments. A popular way to hold individual bonds is by building a portfolio of bonds with various maturities: You should select the number of bonds, maturity dates, and securities that best fit your financial situation and. A bond ladder operates on the principle of diversification, which means spreading your investments. Invest in a range of bonds with different maturity dates. A bond ladder is an investment strategy used to diversify a portfolio of fixed income securities by purchasing bonds with staggered maturities. This is called a bond ladder. A bond ladder is an investment strategy that involves constructing a portfolio in which bonds mature continuously at equally spaced. How does a bond ladder work?. A bond ladder is a portfolio of bonds with varying maturity dates, where the bonds are held to maturity, and their proceeds are reinvested in new bonds.

From www.lordabbett.com

The Municipal Bond Ladder A Timely Response to Rising Rates How Does A Bond Ladder Work A popular way to hold individual bonds is by building a portfolio of bonds with various maturities: This is called a bond ladder. A bond ladder is a portfolio of bonds with varying maturity dates, where the bonds are held to maturity, and their proceeds are reinvested in new bonds. Invest in a range of bonds with different maturity dates.. How Does A Bond Ladder Work.

From www.schwab.com

Bond Laddering Bond Strategy Charles Schwab How Does A Bond Ladder Work A popular way to hold individual bonds is by building a portfolio of bonds with various maturities: This is called a bond ladder. A bond ladder is a portfolio of bonds with varying maturity dates, where the bonds are held to maturity, and their proceeds are reinvested in new bonds. A bond ladder is an investment strategy that involves constructing. How Does A Bond Ladder Work.

From www.oppenheimer.com

Climbing the Ladder How Does A Bond Ladder Work How does a bond ladder work?. A bond ladder is a portfolio of bonds with varying maturity dates, where the bonds are held to maturity, and their proceeds are reinvested in new bonds. This is called a bond ladder. Invest in a range of bonds with different maturity dates. A bond ladder is an investment strategy that involves constructing a. How Does A Bond Ladder Work.

From us.etrade.com

What's a Bond Ladder? Learn More How Does A Bond Ladder Work A bond ladder is a portfolio of bonds with varying maturity dates, where the bonds are held to maturity, and their proceeds are reinvested in new bonds. Invest in a range of bonds with different maturity dates. This is called a bond ladder. A popular way to hold individual bonds is by building a portfolio of bonds with various maturities:. How Does A Bond Ladder Work.

From www.wallstreetoasis.com

What is a Bond Ladder? Corporate Finance Institute Wall Street Oasis How Does A Bond Ladder Work A bond ladder is an investment strategy used to diversify a portfolio of fixed income securities by purchasing bonds with staggered maturities. A bond ladder is a portfolio of bonds with varying maturity dates, where the bonds are held to maturity, and their proceeds are reinvested in new bonds. You should select the number of bonds, maturity dates, and securities. How Does A Bond Ladder Work.

From signetfm.com

An effective tool for investors bond How Does A Bond Ladder Work Invest in a range of bonds with different maturity dates. This is called a bond ladder. You should select the number of bonds, maturity dates, and securities that best fit your financial situation and. A bond ladder operates on the principle of diversification, which means spreading your investments. A bond ladder is a portfolio of bonds with varying maturity dates,. How Does A Bond Ladder Work.

From www.wallstreetoasis.com

What is a Bond Ladder? Corporate Finance Institute Wall Street Oasis How Does A Bond Ladder Work How does a bond ladder work?. You should select the number of bonds, maturity dates, and securities that best fit your financial situation and. Invest in a range of bonds with different maturity dates. A bond ladder is an investment strategy that involves constructing a portfolio in which bonds mature continuously at equally spaced. A bond ladder operates on the. How Does A Bond Ladder Work.

From www.youtube.com

Bond Ladder Series Part 1 The Basics V4 YouTube How Does A Bond Ladder Work A bond ladder is an investment strategy that involves constructing a portfolio in which bonds mature continuously at equally spaced. A bond ladder is an investment strategy used to diversify a portfolio of fixed income securities by purchasing bonds with staggered maturities. Invest in a range of bonds with different maturity dates. A bond ladder operates on the principle of. How Does A Bond Ladder Work.

From www.schwab.com

What Are Bond Ladders? Charles Schwab How Does A Bond Ladder Work A popular way to hold individual bonds is by building a portfolio of bonds with various maturities: This is called a bond ladder. How does a bond ladder work?. A bond ladder is an investment strategy that involves constructing a portfolio in which bonds mature continuously at equally spaced. A bond ladder is a portfolio of bonds with varying maturity. How Does A Bond Ladder Work.

From thesimplesum.com

How to Build a SSB Bond Ladder The Simple Sum Singapore How Does A Bond Ladder Work Invest in a range of bonds with different maturity dates. You should select the number of bonds, maturity dates, and securities that best fit your financial situation and. A popular way to hold individual bonds is by building a portfolio of bonds with various maturities: This is called a bond ladder. How does a bond ladder work?. A bond ladder. How Does A Bond Ladder Work.

From www.flickr.com

How Does Bond a Ladder Work? Invest in multiple bonds with… Flickr How Does A Bond Ladder Work This is called a bond ladder. A bond ladder is an investment strategy that involves constructing a portfolio in which bonds mature continuously at equally spaced. A bond ladder operates on the principle of diversification, which means spreading your investments. A popular way to hold individual bonds is by building a portfolio of bonds with various maturities: How does a. How Does A Bond Ladder Work.

From thecorundumgroup.com

Consider a Bond Ladder for Rising Interest Rates The Corundum Group How Does A Bond Ladder Work A popular way to hold individual bonds is by building a portfolio of bonds with various maturities: Invest in a range of bonds with different maturity dates. A bond ladder operates on the principle of diversification, which means spreading your investments. A bond ladder is an investment strategy used to diversify a portfolio of fixed income securities by purchasing bonds. How Does A Bond Ladder Work.

From www.atxadvisors.com

Portfolios built using Dimensional Fund Advisors and bond ladders How Does A Bond Ladder Work This is called a bond ladder. A bond ladder operates on the principle of diversification, which means spreading your investments. You should select the number of bonds, maturity dates, and securities that best fit your financial situation and. How does a bond ladder work?. A popular way to hold individual bonds is by building a portfolio of bonds with various. How Does A Bond Ladder Work.

From www.fidelity.com

How to build a bond ladder Fidelity How Does A Bond Ladder Work This is called a bond ladder. A popular way to hold individual bonds is by building a portfolio of bonds with various maturities: A bond ladder operates on the principle of diversification, which means spreading your investments. A bond ladder is a portfolio of bonds with varying maturity dates, where the bonds are held to maturity, and their proceeds are. How Does A Bond Ladder Work.

From insights.ipcc.ca

Bond Ladder Strategy Handling Interest Rate Uncertainty How Does A Bond Ladder Work A bond ladder is a portfolio of bonds with varying maturity dates, where the bonds are held to maturity, and their proceeds are reinvested in new bonds. A bond ladder is an investment strategy used to diversify a portfolio of fixed income securities by purchasing bonds with staggered maturities. A bond ladder operates on the principle of diversification, which means. How Does A Bond Ladder Work.

From www.schwab.com

Bond Laddering Bond Strategy Charles Schwab How Does A Bond Ladder Work Invest in a range of bonds with different maturity dates. A popular way to hold individual bonds is by building a portfolio of bonds with various maturities: A bond ladder is an investment strategy used to diversify a portfolio of fixed income securities by purchasing bonds with staggered maturities. How does a bond ladder work?. You should select the number. How Does A Bond Ladder Work.

From www.educba.com

Bond Ladder How Does Bond Ladder Work with goal and example? How Does A Bond Ladder Work A bond ladder operates on the principle of diversification, which means spreading your investments. A bond ladder is a portfolio of bonds with varying maturity dates, where the bonds are held to maturity, and their proceeds are reinvested in new bonds. You should select the number of bonds, maturity dates, and securities that best fit your financial situation and. A. How Does A Bond Ladder Work.

From www.thinkadvisor.com

How to Use a Bond Ladder to Create an Stream ThinkAdvisor How Does A Bond Ladder Work A bond ladder is an investment strategy that involves constructing a portfolio in which bonds mature continuously at equally spaced. A bond ladder is an investment strategy used to diversify a portfolio of fixed income securities by purchasing bonds with staggered maturities. This is called a bond ladder. A bond ladder operates on the principle of diversification, which means spreading. How Does A Bond Ladder Work.